ABUJA: Nigeria LNG Ltd (NLNG) has signed landmark 20-year gas supply agreements with the Nigerian National Petroleum Company Ltd (NNPC) and a consortium of domestic and international oil firms, ensuring a steady feed of 1.29 billion standard cubic feet per day (bscf/d) for its existing and upcoming liquefaction plants.

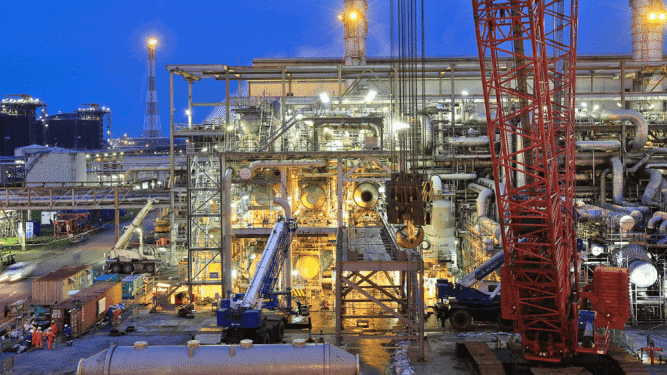

The contracts covering firms such as Shell Nigeria, Oando Group, Aradel Holdings, and First E&P are designed to mitigate upstream gas shortfalls that have long constrained production. Crucially, they provide the backbone for the $10 billion Train-7 project on Bonny Island, Rivers State, now 80% complete. Once operational, Train-7 is expected to boost NLNG’s capacity by 35%, positioning Nigeria more competitively in the global LNG market.

Bayo Ojulari, NNPC Group CEO, said the deals not only resolve long-standing supply bottlenecks but also create “fresh avenues for growth, collaboration, and shared prosperity.” Philip Mshelbila, NLNG’s Managing Director, stressed that the contracts reflect the company’s strategy of diversifying feedgas sources in the wake of international oil companies divesting from onshore assets. They also address recurring pipeline sabotage and vandalism, which have disrupted supplies for years.

Industry analysts say the deals arrive at a pivotal moment. With global LNG demand expected to surge by nearly 50% by 2030, Nigeria is well-positioned to fill supply gaps, especially as Europe and parts of Asia seek alternatives to Russian gas. Nigeria’s LNG exports, already one of the country’s top foreign exchange earners, are projected to rise sharply once Train-7 comes online.

The broader opportunity extends beyond LNG. The new contracts signal Nigeria’s intent to leverage its 206 trillion cubic feet of proven gas reserves to industrialize, boost domestic power generation, and attract foreign investment into gas-to-power, petrochemicals, and fertilizer industries. The move aligns with Nigeria’s “Decade of Gas” initiative, which seeks to transition the country from an oil-dependent economy to a gas-driven industrial hub.

However, challenges remain. Pipeline insecurity, inadequate infrastructure, and policy uncertainties continue to cast a shadow over Nigeria’s energy sector. Experts argue that unless the government accelerates regulatory reforms and invests in security and infrastructure, Nigeria risks losing market share to emerging LNG producers like Mozambique and Qatar’s aggressive expansion plans.

NLNG, a joint venture owned by NNPC Ltd (49%), Shell Gas (25.6%), TotalEnergies (15%), and Eni (10.4%), remains central to Nigeria’s economic diversification. Its long-term supply deals underscore investor confidence in Nigeria’s LNG future, even as global energy transition pressures intensify.

For local businesses, the contracts open fresh opportunities in logistics, shipping, equipment supply, and technical services linked to LNG infrastructure. Analysts note that if Nigeria can stabilize supply chains, it could attract billions in ancillary investments, creating jobs and reinforcing Nigeria’s position as Africa’s gas powerhouse.

⁃ Isaac Anyaogu with Dr. Shahid Siddiqui

WATCH, LIKE & SUBSCRIBE FOR EXCLUSIVE TALKS